EX-99.3

Published on October 21, 2024

Exhibit 99.3 Investor Update October 21, 2024

Cautionary Statements About this Presentation The information in this presentation is current only as of the date on its cover. For any time after the cover date of this presentation, the information, including information concerning the business, financial condition, results of operations and prospects of Construction Partners, Inc. (“CPI” or the “Company”), may have changed. The delivery of this presentation shall not, under any circumstances, create any implication that there have been no changes in the Company’s affairs after the date of this presentation. The Company’s fiscal year ends on September 30th of any given year, and the fiscal year of Asphalt Inc., LLC d/b/a Lone Star Paving (“LSP”) has historically ended on December 31st of any given year. Any reference in this presentation to a fiscal year refers to the fiscal year ended September 30th of that year, unless otherwise noted. The Company has not authorized any person to give any information or to make any representations about the Company in connection with this presentation that are not contained herein. If any information has been or is given or any representations have been or are made to you outside of this presentation, such information or representations should not be relied upon as having been authorized by the Company. Forward-Looking Statements Certain statements contained herein relating to the Company or LSP that are not statements of historical or current fact constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. These statements may be identified by the use of words such as “seek,” “continue,” “estimate,” “predict,” “potential,” “targeting,” “could,” “might,” “may,” “will,” “expect,” “should,” “anticipate,” “intend,” “project,” “outlook,” “believe,” “plan” and similar expressions or their negative. These forward-looking statements include, among others, statements regarding the anticipated timing of closing the Company’s acquisition of LSP; estimates of future synergies, savings and efficiencies relating to the Company’s acquisition of LSP; expectations regarding the Company’s ability to effectively integrate assets and properties it may acquire as a result of the Company’s acquisition of LSP; expectations of future plans, priorities, focuses, and benefits of the Company’s acquisition of LSP; expectations regarding the Company’s ability to obtain financing in connection with its acquisition of LSP; and statements regarding the expected financial performance of the Company following its acquisition of LSP, including statements regarding the Company’s expected Revenue, Net Income, Adjusted EBITDA and Adjusted EBITDA Margin for the fiscal year ended September 30, 2024. Important factors that could cause actual results to differ materially from those expressed in the forward-looking statements, include, among others, the ability of the parties to consummate the acquisition of LSP in a timely manner, or at all; satisfaction of any conditions precedent to the consummation of the Company’s acquisition of LSP, including the ability to obtain required regulatory approvals in a timely manner, or at all; the Company’s ability to obtain financing to fund its acquisition of LSP on favorable terms, or at all; failure to realize the anticipated benefits of the Company’s acquisition of LSP; the preliminary financial information remaining subject to changes and finalization based upon management’s ongoing review of results for the fiscal year ended September 30, 2024 and the completion of all year-end closing procedures; and the other risks, uncertainties and factors set forth in the Company’s most recent Annual Report on Form 10-K, its subsequent Quarterly Reports on Form 10-Q, its Current Reports on Form 8-K and other reports the Company files with the Securities and Exchange Commission (the “SEC”). Forward-looking statements speak only as of the date they are made. The Company assumes no obligation to update forward-looking statements to reflect actual results, subsequent events, or circumstances or other changes affecting such statements, except to the extent required by applicable law. Preliminary Financial Results This presentation includes certain preliminary financial information regarding the Company’s fiscal year ended September 30, 2024. The Company’s independent registered public accounting firm has not audited, reviewed, compiled or performed any procedures with respect to such preliminary financial information or its audit of the Company’s financial statements for the fiscal year ended September 30, 2024. The Company’s actual results may differ from these estimates as a result of the Company’s year-end closing procedures, review adjustments and other developments that may arise between now and the time the Company’s financial results for the fiscal year ended September 30, 2024 are finalized. Page 2

Cautionary Statements (cont’d) Use of Non-GAAP Financial Information The Company presents Adjusted EBITDA and Adjusted EBTIDA Margin to help the Company describe its operating and financial performance. These financial measures do not conform to accounting principles generally accepted in the United States (“GAAP”), are commonly used in the Company’s industry and have certain limitations and should not be construed as alternatives to net income and other income data measures (as determined in accordance with GAAP), or as better indicators of operating performance. These non-GAAP financial measures, as defined by the Company, may not be comparable to similar non-GAAP financial measures presented by other companies. The Company’s presentation of such measures should not be construed as an inference that its future results will be unaffected by unusual or non-recurring items. For additional information regarding the Company’s use of non-GAAP financial information, as well as reconciliations of non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP, please see the appendix to this presentation. Asphalt Inc., LLC d/b/a Lone Star Paving The information and data relating to LSP contained in this presentation is based on information provided by LSP that we believe is accurate, but we have not independently verified such information. This data is subject to change and may not be reliable. Combined Results The financial information included in this presentation is not intended to comply with the requirements of Regulation S-X under the Securities Act and the rules and regulations of the SEC promulgated thereunder, in particular with respect to the presentation of any pro forma financial information. As a result, the information that the Company files with the SEC at a later date may differ from the information contained in this presentation in order to comply with SEC rules. The combined results contained herein have been prepared by the Company’s management solely based on adding the historical financial statements of the Company and LSP for the applicable periods and have not been prepared or reviewed by any independent accounting firm. The combined results contained herein do not purport to contain all of the information that a prospective investor may desire in evaluating the proposed acquisition of LSP and/or the related transactions. Industry and Market Data This presentation contains statistical and market data that the Company obtained from industry publications, reports generated by third parties, third-party studies, and public filings. Although the Company believes that the publications, reports, studies, and filings are reliable as of the date of this presentation, the Company has not independently verified such statistical or market data. The industry in which the Company operates is subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause results to differ materially from those expressed in these publications and reports. Page 3

Construction Partners, Inc. Enters into Definitive Agreement to Acquire Platform Company in Texas • CPI to acquire Lone Star Paving (LSP) in Austin, Texas for $654mm in cash and 3mm shares of CPI Class A common (1) stock • Transaction expected to close in 1Q25 and be immediately accretive to earnings • Transformational transaction expected to significantly accelerate CPI’s ROAD-Map 2027 goals • LSP is a vertically integrated infrastructure company servicing three of the fastest growing metropolitan areas (2) in the U.S., generating Reported EBITDA Margin in (3) excess of 20% for LTM ended June 30, 2024 • Expected to generate annualized revenue of $530mm (3) and $120mm of Adjusted EBITDA in FY25 (1) In addition to $654.2 million in cash (subject to customary adjustments) and 3 million shares to be issued at closing, (a) cash in an amount equal to the working capital remaining in LSP at the closing, as finally determined (subject to adjustments and offsets to satisfy certain of the sellers’ indemnification obligations and any purchase price overpayments), is to be paid out in quarterly installments over four quarters following the closing, and (b) as a condition to closing, CPI and the sellers will execute a conditional purchase agreement whereby CPI will agree to purchase from the sellers, upon receipt of necessary governmental entitlements, an entity that owns certain real property located in Central Texas for $30 million in cash. (2) Reported EBITDA Margin is a financial measure not presented in accordance with GAAP. For a reconciliation of Reported EBITDA Margin to Net Income, the most directly comparable GAAP financial measure, see the Appendix. (3) A reconciliation of forward-looking Adjusted EBITDA and Reported EBITDA Margin for LSP to the most directly comparable forward-looking GAAP measure of Net Income is not provided because management cannot predict with a reasonable degree of certainty and without unreasonable efforts certain excluded items that are inherently uncertain and depend on various factors. For these reasons, CPI is unable to assess the probable significance of the unavailable information. Page 4

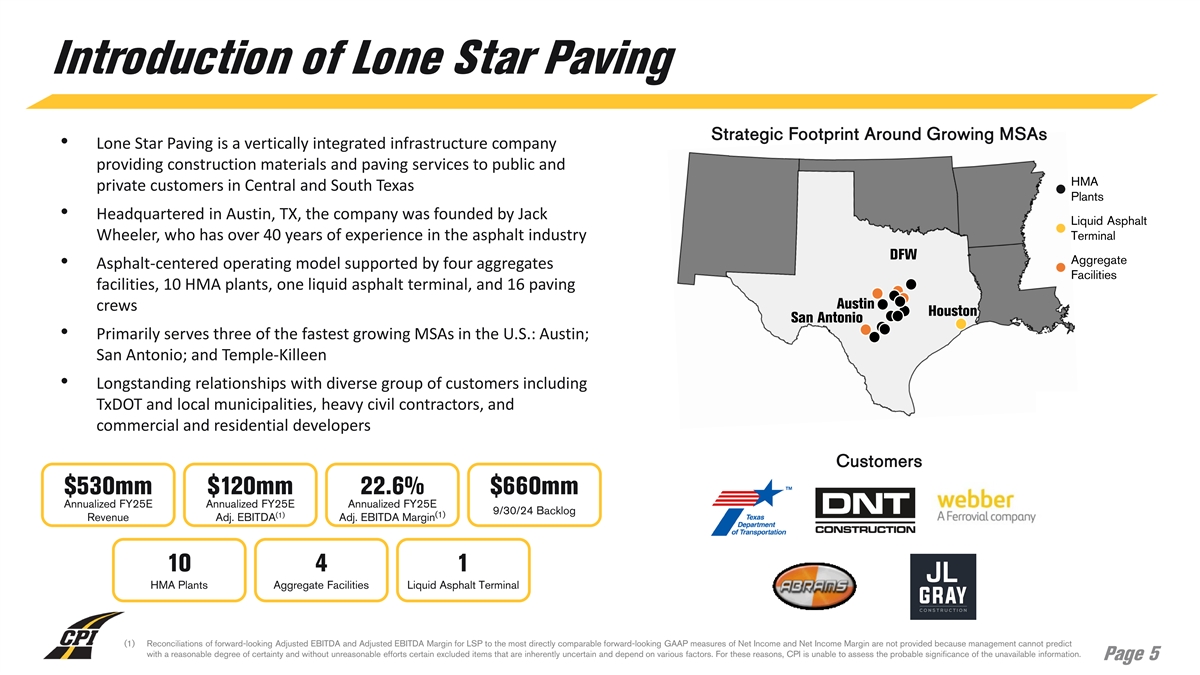

Introduction of Lone Star Paving Strategic Footprint Around Growing MSAs • Lone Star Paving is a vertically integrated infrastructure company providing construction materials and paving services to public and HMA private customers in Central and South Texas Plants • Headquartered in Austin, TX, the company was founded by Jack Liquid Asphalt Wheeler, who has over 40 years of experience in the asphalt industry Terminal DFW Aggregate • Asphalt-centered operating model supported by four aggregates Facilities facilities, 10 HMA plants, one liquid asphalt terminal, and 16 paving Austin crews Houston San Antonio • Primarily serves three of the fastest growing MSAs in the U.S.: Austin; San Antonio; and Temple-Killeen • Longstanding relationships with diverse group of customers including TxDOT and local municipalities, heavy civil contractors, and commercial and residential developers Customers $530mm $120mm 22.6% $660mm Annualized FY25E Annualized FY25E Annualized FY25E 9/30/24 Backlog (1) (1) Revenue Adj. EBITDA Adj. EBITDA Margin 10 4 1 HMA Plants Aggregate Facilities Liquid Asphalt Terminal (1) Reconciliations of forward-looking Adjusted EBITDA and Adjusted EBITDA Margin for LSP to the most directly comparable forward-looking GAAP measures of Net Income and Net Income Margin are not provided because management cannot predict with a reasonable degree of certainty and without unreasonable efforts certain excluded items that are inherently uncertain and depend on various factors. For these reasons, CPI is unable to assess the probable significance of the unavailable information. Page 5

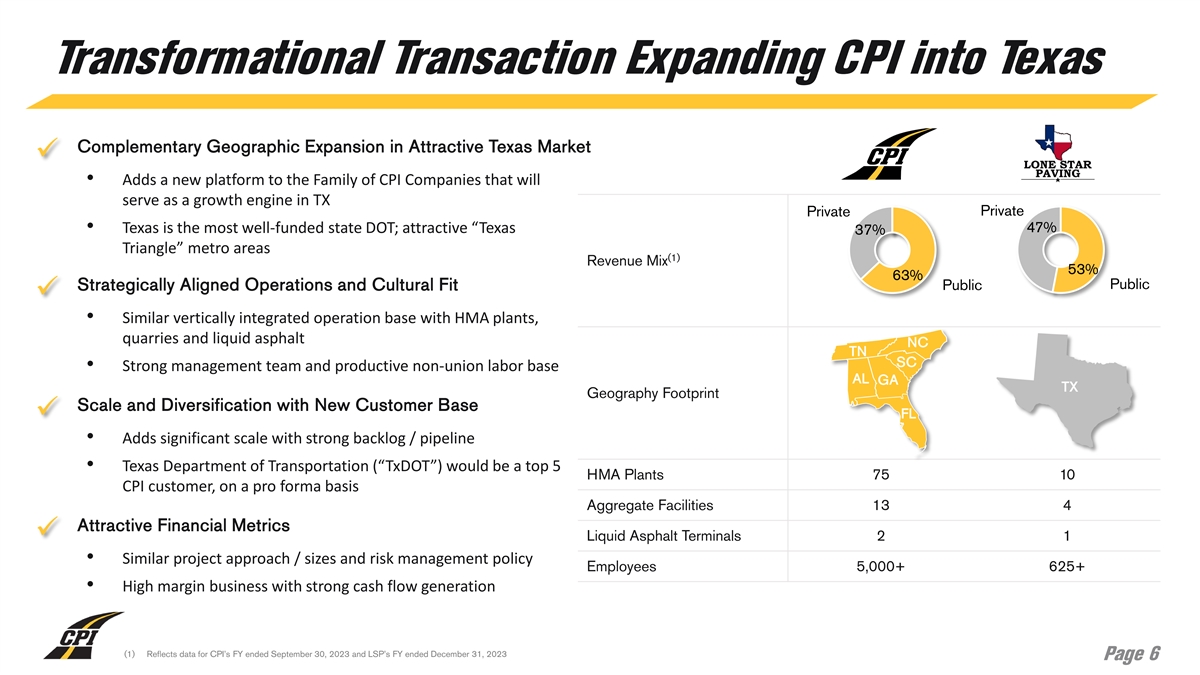

Transformational Transaction Expanding CPI into Texas Complementary Geographic Expansion in Attractive Texas Market ü • Adds a new platform to the Family of CPI Companies that will serve as a growth engine in TX Private Private 47% • Texas is the most well-funded state DOT; attractive “Texas 37% Triangle” metro areas (1) Revenue Mix 53% 63% Public Strategically Aligned Operations and Cultural Fit Public ü • Similar vertically integrated operation base with HMA plants, quarries and liquid asphalt NC TN SC • Strong management team and productive non-union labor base AL GA TX Geography Footprint Scale and Diversification with New Customer Base ü FL • Adds significant scale with strong backlog / pipeline • Texas Department of Transportation (“TxDOT”) would be a top 5 HMA Plants 75 10 CPI customer, on a pro forma basis Aggregate Facilities 13 4 Attractive Financial Metrics ü Liquid Asphalt Terminals 2 1 • Similar project approach / sizes and risk management policy Employees 5,000+ 625+ • High margin business with strong cash flow generation (1) Reflects data for CPI’s FY ended September 30, 2023 and LSP’s FY ended December 31, 2023 Page 6

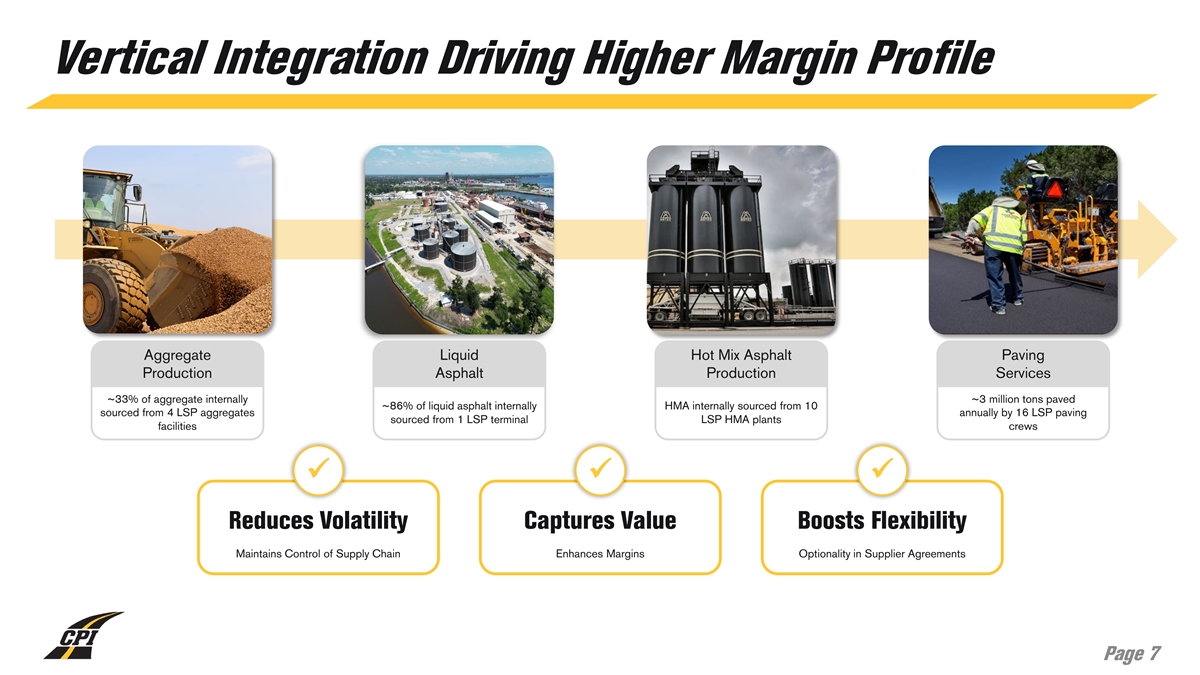

Vertical Integration Driving Higher Margin Profile Aggregate Liquid Hot Mix Asphalt Paving Production Asphalt Production Services ~33% of aggregate internally ~3 million tons paved ~86% of liquid asphalt internally HMA internally sourced from 10 sourced from 4 LSP aggregates annually by 16 LSP paving sourced from 1 LSP terminal LSP HMA plants facilities crews üüü Reduces Volatility Captures Value Boosts Flexibility Maintains Control of Supply Chain Enhances Margins Optionality in Supplier Agreements Page 7

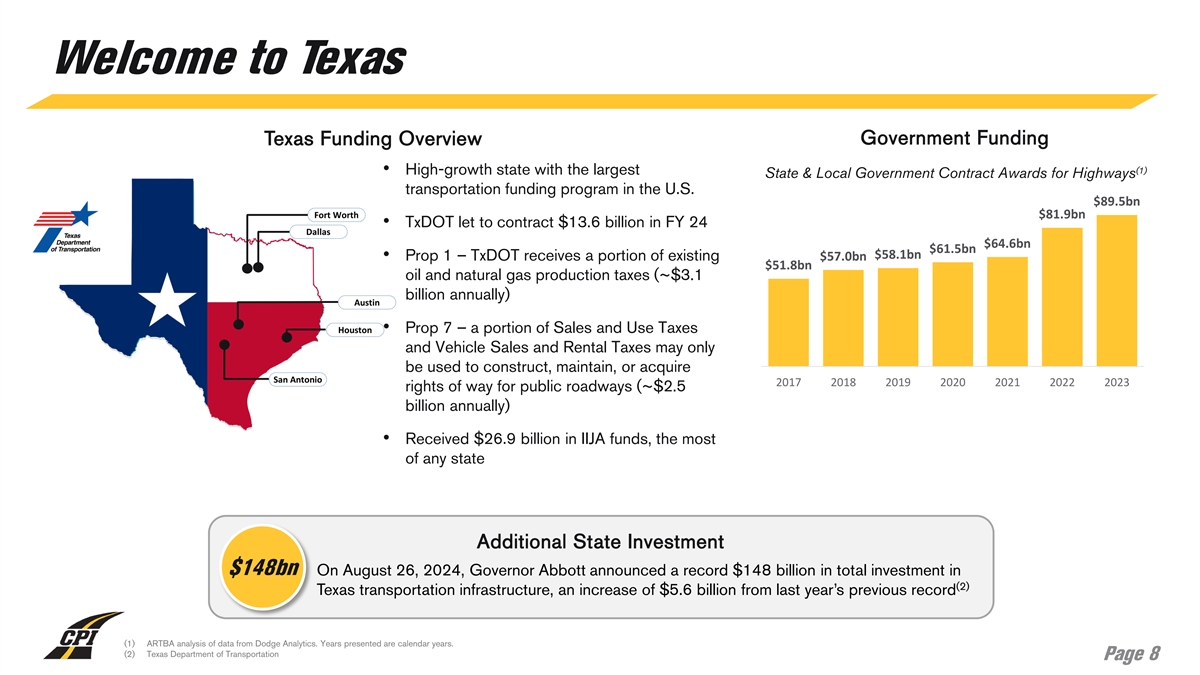

Welcome to Texas Texas Funding Overview Government Funding (1) • High-growth state with the largest State & Local Government Contract Awards for Highways transportation funding program in the U.S. $89.5bn $81.9bn • TxDOT let to contract $13.6 billion in FY 24 $64.6bn $61.5bn $58.1bn • Prop 1 – TxDOT receives a portion of existing $57.0bn $51.8bn oil and natural gas production taxes (~$3.1 billion annually) • Prop 7 – a portion of Sales and Use Taxes and Vehicle Sales and Rental Taxes may only be used to construct, maintain, or acquire 2017 2018 2019 2020 2021 2022 2023 rights of way for public roadways (~$2.5 billion annually) • Received $26.9 billion in IIJA funds, the most of any state Additional State Investment $148bn On August 26, 2024, Governor Abbott announced a record $148 billion in total investment in (2) Texas transportation infrastructure, an increase of $5.6 billion from last year’s previous record (1) ARTBA analysis of data from Dodge Analytics. Years presented are calendar years. (2) Texas Department of Transportation Page 8

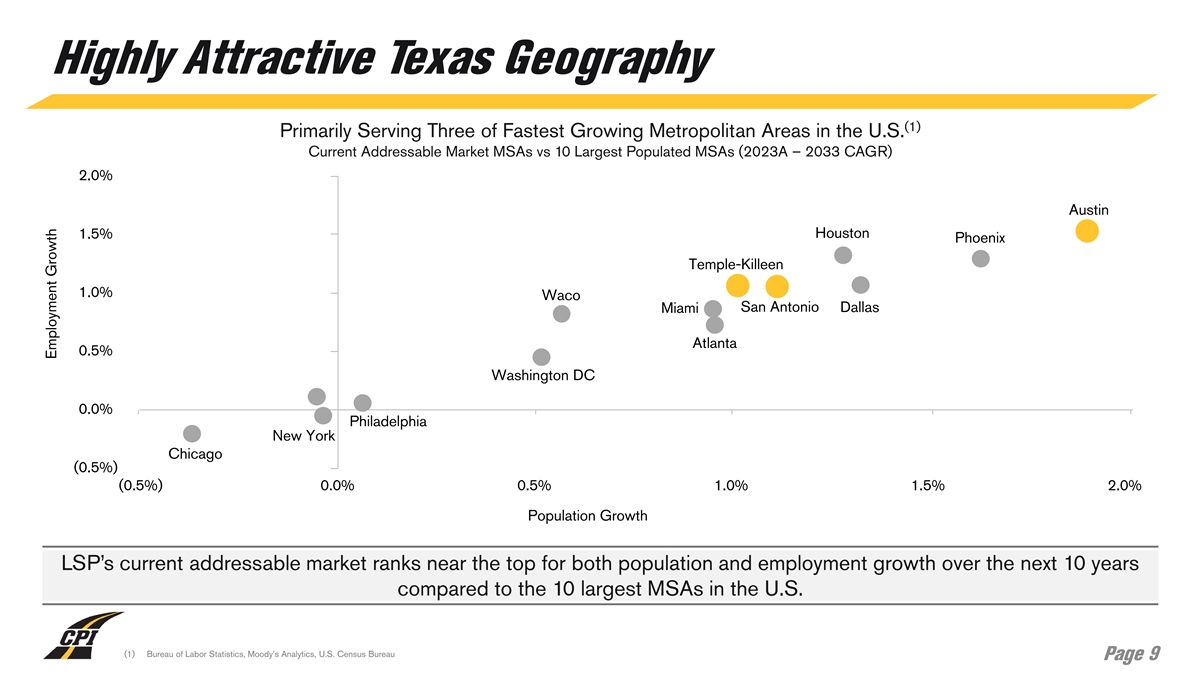

Highly Attractive Texas Geography (1) Primarily Serving Three of Fastest Growing Metropolitan Areas in the U.S. Current Addressable Market MSAs vs 10 Largest Populated MSAs (2023A – 2033 CAGR) 2.0% Austin Houston 1.5% Phoenix Temple-Killeen 1.0% Waco Miami San Antonio Dallas Atlanta 0.5% Washington DC 0.0% Philadelphia New York Chicago (0.5%) (0.5%) 0.0% 0.5% 1.0% 1.5% 2.0% Population Growth LSP’s current addressable market ranks near the top for both population and employment growth over the next 10 years compared to the 10 largest MSAs in the U.S. (1) Bureau of Labor Statistics, Moody’s Analytics, U.S. Census Bureau Page 9 Employment Growth

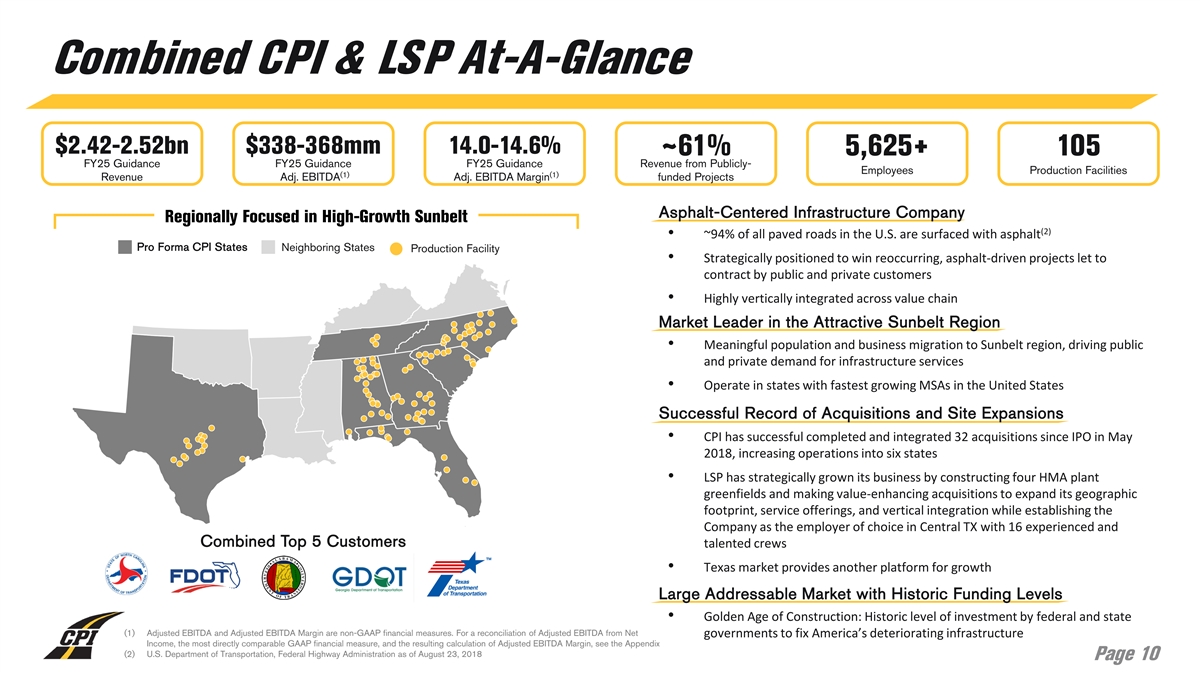

Combined CPI & LSP At-A-Glance $2.42-2.52bn $338-368mm 14.0-14.6% ~61% 5,625+ 105 FY25 Guidance FY25 Guidance FY25 Guidance Revenue from Publicly- Employees Production Facilities (1) (1) Revenue Adj. EBITDA Adj. EBITDA Margin funded Projects Asphalt-Centered Infrastructure Company Regionally Focused in High-Growth Sunbelt (2) • ~94% of all paved roads in the U.S. are surfaced with asphalt Pro Forma CPI States Neighboring States Production Facility • Strategically positioned to win reoccurring, asphalt-driven projects let to contract by public and private customers • Highly vertically integrated across value chain Market Leader in the Attractive Sunbelt Region • Meaningful population and business migration to Sunbelt region, driving public and private demand for infrastructure services • Operate in states with fastest growing MSAs in the United States Successful Record of Acquisitions and Site Expansions • CPI has successful completed and integrated 32 acquisitions since IPO in May 2018, increasing operations into six states • LSP has strategically grown its business by constructing four HMA plant greenfields and making value-enhancing acquisitions to expand its geographic footprint, service offerings, and vertical integration while establishing the Company as the employer of choice in Central TX with 16 experienced and Combined Top 5 Customers talented crews • Texas market provides another platform for growth Large Addressable Market with Historic Funding Levels • Golden Age of Construction: Historic level of investment by federal and state (1) Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures. For a reconciliation of Adjusted EBITDA from Net governments to fix America’s deteriorating infrastructure Income, the most directly comparable GAAP financial measure, and the resulting calculation of Adjusted EBITDA Margin, see the Appendix (2) U.S. Department of Transportation, Federal Highway Administration as of August 23, 2018 Page 10

Financial Outlook

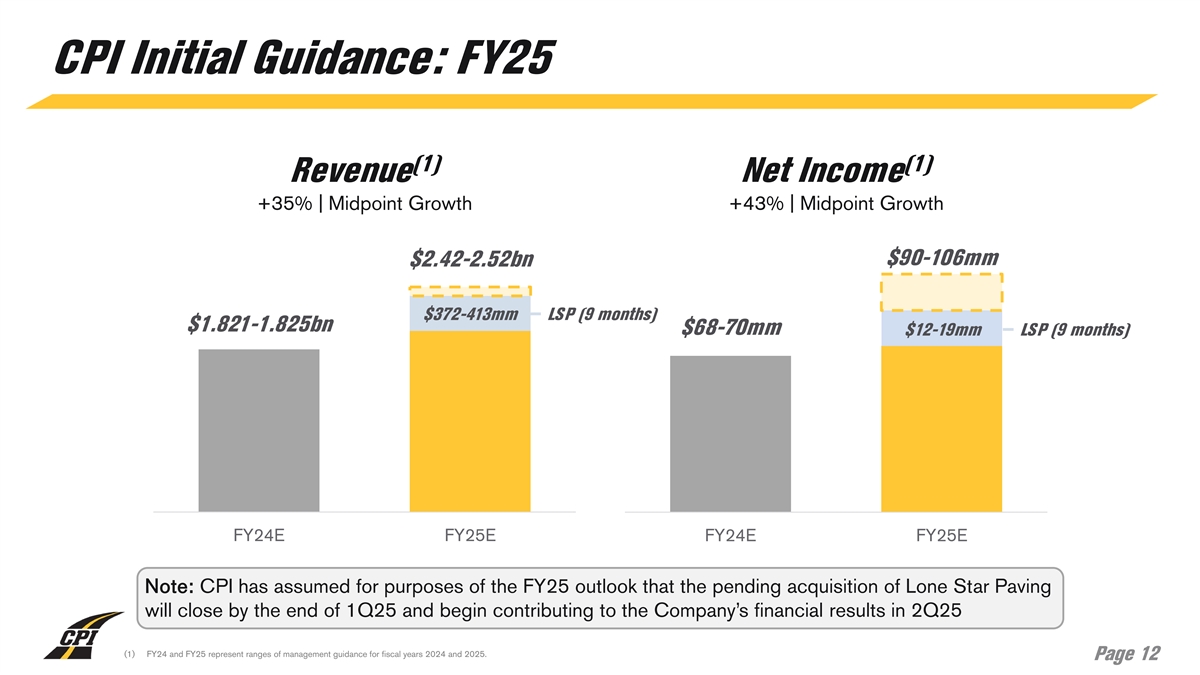

CPI Initial Guidance: FY25 (1) (1) Revenue Net Income +35% | Midpoint Growth +43% | Midpoint Growth $90-106mm $2.42-2.52bn $372-413mm LSP (9 months) $1.821-1.825bn $68-70mm $12-19mm LSP (9 months) FY24E FY25E FY24E FY25E Note: CPI has assumed for purposes of the FY25 outlook that the pending acquisition of Lone Star Paving will close by the end of 1Q25 and begin contributing to the Company’s financial results in 2Q25 (1) FY24 and FY25 represent ranges of management guidance for fiscal years 2024 and 2025. Page 12

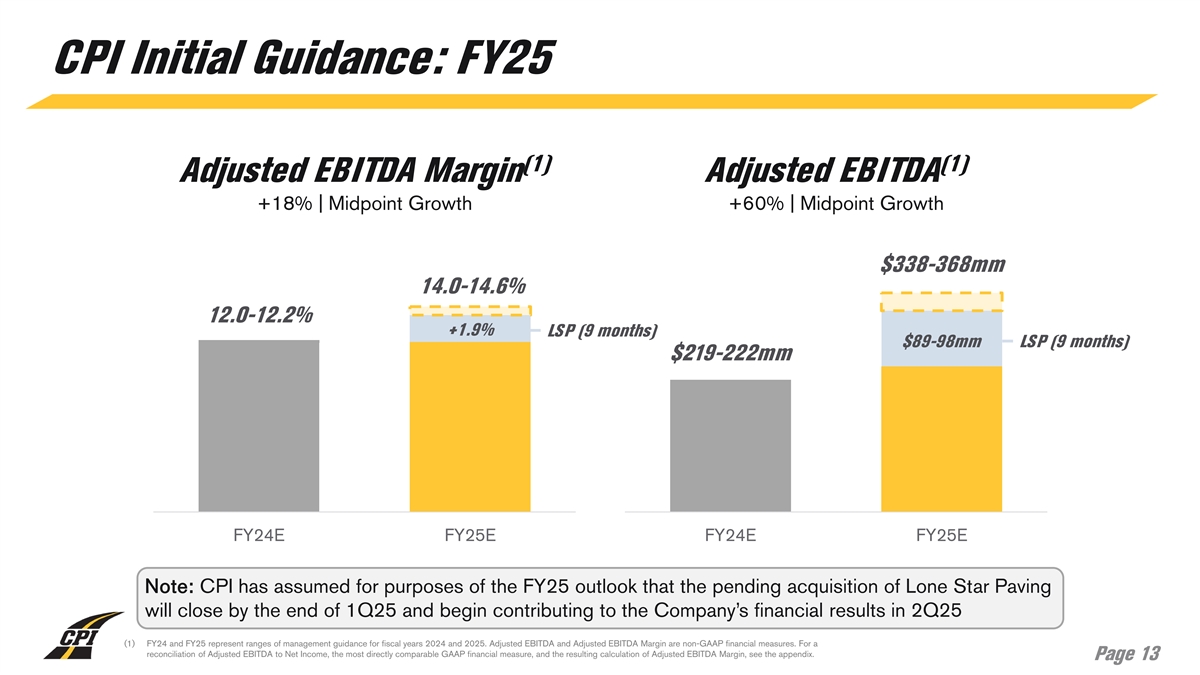

CPI Initial Guidance: FY25 (1) (1) Adjusted EBITDA Margin Adjusted EBITDA +18% | Midpoint Growth +60% | Midpoint Growth $338-368mm 14.0-14.6% 12.0-12.2% +1.9% LSP (9 months) $89-98mm LSP (9 months) $219-222mm FY24E FY25E FY24E FY25E Note: CPI has assumed for purposes of the FY25 outlook that the pending acquisition of Lone Star Paving will close by the end of 1Q25 and begin contributing to the Company’s financial results in 2Q25 (1) FY24 and FY25 represent ranges of management guidance for fiscal years 2024 and 2025. Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures. For a reconciliation of Adjusted EBITDA to Net Income, the most directly comparable GAAP financial measure, and the resulting calculation of Adjusted EBITDA Margin, see the appendix. Page 13

Appendix

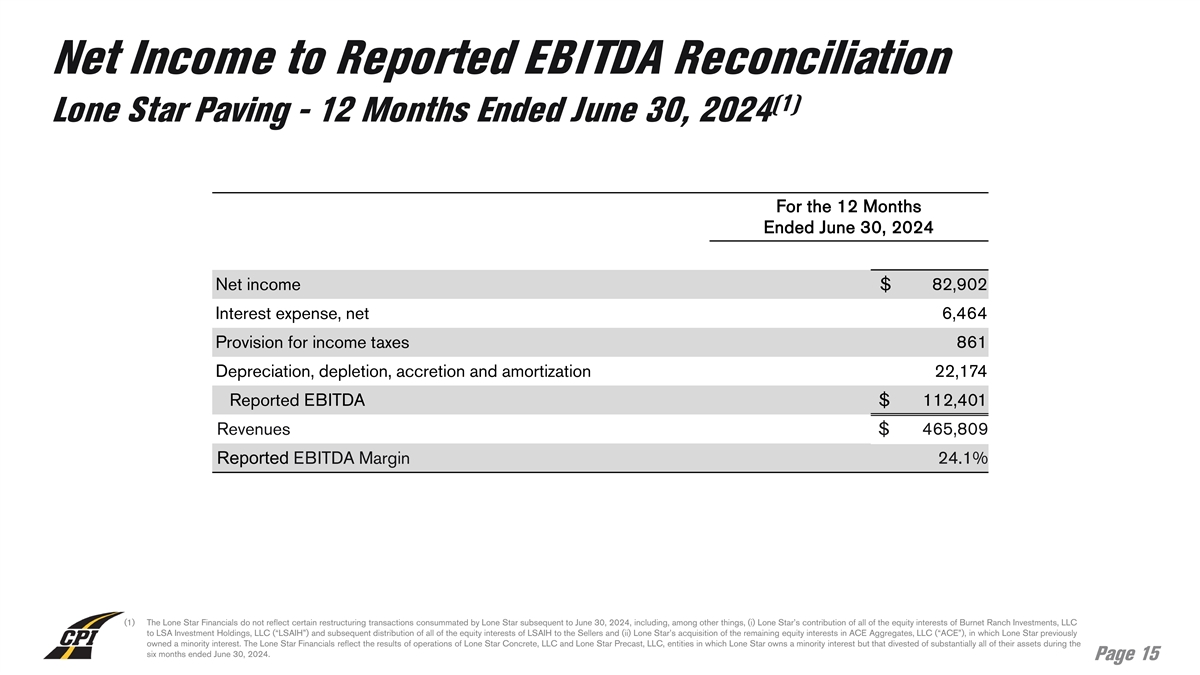

Net Income to Reported EBITDA Reconciliation (1) Lone Star Paving - 12 Months Ended June 30, 2024 For the 12 Months Ended June 30, 2024 Net income $ 82,902 Interest expense, net 6,464 Provision for income taxes 861 Depreciation, depletion, accretion and amortization 22,174 Reported EBITDA $ 112,401 Revenues $ 465,809 Reported EBITDA Margin 24.1% (1) The Lone Star Financials do not reflect certain restructuring transactions consummated by Lone Star subsequent to June 30, 2024, including, among other things, (i) Lone Star’s contribution of all of the equity interests of Burnet Ranch Investments, LLC to LSA Investment Holdings, LLC (“LSAIH”) and subsequent distribution of all of the equity interests of LSAIH to the Sellers and (ii) Lone Star’s acquisition of the remaining equity interests in ACE Aggregates, LLC (“ACE”), in which Lone Star previously owned a minority interest. The Lone Star Financials reflect the results of operations of Lone Star Concrete, LLC and Lone Star Precast, LLC, entities in which Lone Star owns a minority interest but that divested of substantially all of their assets during the six months ended June 30, 2024. Page 15

Net Income to Adjusted EBITDA Reconciliation Construction Partners, Inc. - Fiscal Year 2024 Updated Outlook For the Fiscal Year Ended September 30, 2024 Low High Net income $ 68,000 $ 70,000 Interest expense, net 18,750 18,900 Provision (benefit) for income taxes 22,850 23,000 Depreciation, depletion, and amortization 93,000 93,100 Equity-based compensation expense 15,000 15,250 Acquisition expenses 1,400 1,500 Adjusted EBITDA $ 219,000 $ 221,750 Revenues $ 1,821,000 $ 1,825,000 Adjusted EBITDA Margin 12.0% 12.2% Page 16

Net Income to Adjusted EBITDA Reconciliation Construction Partners, Inc. - Fiscal Year 2025 Outlook For the Fiscal Year Ended September 30, 2025 Low High Net income $ 90,363 $ 105,636 Interest expense, net 65,000 65,000 Provision (benefit) for income taxes 30,137 35,864 Depreciation, depletion, and amortization 128,000 137,000 Equity-based compensation expense 21,500 21,500 Acquisition expenses 3,000 3,000 Adjusted EBITDA $ 338,000 $ 368,000 Revenues $ 2,420,000 $ 2,520,000 Adjusted EBITDA Margin 14.0% 14.6% Page 17