DRS/A: Draft registration statement submitted by Emerging Growth Company under Securities Act Section 6(e) or by Foreign Private Issuer under Division of Corporation Finance policy

Published on December 20, 2017

Table of Contents

As confidentially submitted to the Securities and Exchange Commission on December 20, 2017

This draft registration statement has not been publicly filed with the Securities and Exchange Commission and all information herein remains strictly confidential

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Construction Partners, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 1600 | 26-0758017 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

290 Healthwest Drive, Suite 2

Dothan, Alabama 36303

(334) 673-9763

(Address, including zip code and telephone number, including area code, of registrants principal executive offices)

Charles E. Owens

Chief Executive Officer and President

Construction Partners, Inc.

290 Healthwest Drive, Suite 2

Dothan, Alabama 36303

(334) 673-9763

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies to:

| Garrett A. DeVries Akin Gump Strauss Hauer & Feld LLP 1700 Pacific Avenue, Suite 4100 Dallas, Texas 75201 (214) 969-2800 |

Christopher D. Lueking Latham & Watkins LLP 330 North Wabash Avenue, Suite 2800 Chicago, Illinois 60611 (312) 876-7700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the Securities Act), check the following box. ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, smaller reporting company and emerging growth company in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

CALCULATION OF REGISTRATION FEE

|

|

||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) |

||

| Class A Common Stock, par value $0.001 per share |

$ | $ | ||

|

|

||||

|

|

||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act. |

| (2) | Includes the offering price of Class A common stock that may be purchased by the underwriters upon the exercise of their option to purchase additional shares. |

| (3) | To be paid in connection with the initial public filing of the registration statement. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated , 2018

PROSPECTUS

Shares

CONSTRUCTION PARTNERS, INC.

CLASS A COMMON STOCK

This is the initial public offering of Class A common stock of Construction Partners, Inc. We are offering shares of our Class A common stock. The selling stockholders identified in this prospectus are offering shares of our Class A common stock. We will not receive any of the proceeds from the sale of shares of our Class A common stock by the selling stockholders.

Prior to this offering, there has been no public market for our Class A common stock. We anticipate that the initial public offering price for our Class A common stock will be between $ and $ per share. We intend to apply to list our Class A common stock on under the symbol .

Investing in our Class A common stock involves substantial risk. See Risk Factors on page 13.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

We are an emerging growth company under the U.S. federal securities laws and will be subject to reduced public company reporting requirements.

| Per Share | Total | |||||||||

| Initial public offering price |

$ | $ | ||||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||||

| Proceeds to us, before expenses |

$ | $ | ||||||||

| Proceeds to selling stockholders, before expenses |

$ | $ | ||||||||

| (1) | We have agreed to reimburse the underwriters for certain expenses. See Underwriting. |

Delivery of the shares of our Class A common stock is expected to be made on or about , 2018.

The selling stockholders have granted the underwriters a 30-day option to purchase up to an additional shares of our Class A common stock at the initial public offering price less underwriting discounts and commissions.

Upon the completion of this offering, we will have two classes of authorized common stock: our Class A common stock and our Class B common stock. The rights of holders of our Class A common stock and our Class B common stock will be identical, except with respect to voting rights, conversion rights and certain transfer restrictions applicable to our Class B common stock. Each share of our Class A common stock will be entitled to one vote. Each share of our Class B common stock will be entitled to votes and is convertible into one share of our Class A common stock automatically upon transfer, subject to certain exceptions. Upon the completion of this offering, the holders of our Class A common stock will hold approximately % of the total voting power of our outstanding common stock and approximately % of our total equity ownership (or % and %, respectively, if the underwriters option to purchase additional shares is exercised in full), and the holders of our Class B common stock will hold approximately % of the total voting power of our outstanding common stock and approximately % of our total equity ownership (or % and %, respectively, if the underwriters option to purchase additional shares is exercised in full). See Description of Our Capital StockCommon Stock.

Following the completion of this offering, we will be a controlled company within the meaning of the corporate governance rules of . See ManagementDirector Independence and Controlled Company Exemption.

| Baird | Raymond James | Stephens Inc. |

Imperial Capital

Prospectus dated , 2018

Table of Contents

| Page | ||||

| ii | ||||

| ii | ||||

| 1 | ||||

| 13 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 41 | ||||

| 43 | ||||

| Managements Discussion and Analysis of Financial Condition and Results of Operations |

45 | |||

| 60 | ||||

| 75 | ||||

| 80 | ||||

| 88 | ||||

| 91 | ||||

| 93 | ||||

| 103 | ||||

| Material U.S. Federal Income Tax Consequences for Non-U.S. Holders |

106 | |||

| 110 | ||||

| 117 | ||||

| 117 | ||||

| 117 | ||||

| 117 | ||||

| Index to Consolidated Financial Statements and Supplementary Data |

F-1 | |||

You should rely only on the information contained in this prospectus. Neither we, the selling stockholders nor the underwriters have authorized any other person to provide you with any information, or to make any representations, other than as contained in this prospectus, in any amendment or supplement hereto or in any free writing prospectus prepared by us or on our behalf and delivered or made available to you. Neither we, the selling stockholders nor the underwriters take responsibility for or provide assurance as to the reliability of any information or representations that others may give you. This prospectus is an offer to sell only the shares of our Class A common stock offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date hereof, and we undertake no obligation to update such information, except as may be required by law.

i

Table of Contents

Unless otherwise indicated, information contained in this prospectus concerning our industry, our market share and the markets that we serve is based on information from independent industry and research organizations, other third-party sources (including industry publications, surveys and forecasts) and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data and our knowledge of such industry and markets that we believe to be reasonable. Although we believe the data from these third-party sources is reliable, we have not independently verified any such information. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in Risk Factors and Cautionary Statement Regarding Forward-Looking Statements. These and other factors could cause results to differ materially from those expressed in the estimates made by third-parties and by us.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve risks and uncertainties, such as statements related to future events, business strategy, future performance, future operations, backlog, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management. All statements other than statements of historical fact may be forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as seek, anticipate, plan, continue, estimate, expect, may, will, project, predict, potential, targeting, intend, could, might, should, believe and similar expressions or their negative. Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on managements belief, based on currently available information, as to the outcome and timing of future events. These statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those expressed in such forward-looking statements. When evaluating forward-looking statements, you should consider the risk factors and other cautionary statements described in Risk Factors. We believe the expectations reflected in the forward-looking statements contained in this prospectus are reasonable, but no assurance can be given that these expectations will prove to be correct. Forward-looking statements should not be unduly relied upon.

Important factors that could cause actual results or events to differ materially from those expressed in forward-looking statements include, but are not limited to:

| ● | declines in public infrastructure construction and reductions in government funding, including the funding by transportation authorities and other state and local agencies; |

| ● | risks related to our operating strategy; |

| ● | competition for projects in our local markets; |

| ● | risks associated with our capital-intensive business; |

| ● | government requirements and initiatives, including those related to funding for public or infrastructure construction, land usage and environmental, health and safety matters; |

| ● | unfavorable economic conditions and restrictive financing markets; |

| ● | our ability to successfully identify, manage and integrate acquisitions; |

| ● | our ability to obtain sufficient bonding capacity to undertake certain projects; |

| ● | our ability to accurately estimate the overall risks, requirements or costs when we bid on or negotiate contracts that are ultimately awarded to us; |

| ● | cancellation of a significant number of contracts or our disqualification from bidding for new contracts; |

ii

Table of Contents

| ● | risks related to adverse weather conditions; |

| ● | our substantial indebtedness and the restrictions imposed on us by the terms thereof; |

| ● | our ability to maintain favorable relationships with third parties that supply us with equipment and essential supplies; |

| ● | our ability to retain key personnel and maintain satisfactory labor relations; |

| ● | property damage, results of litigation and other claims and insurance coverage issues; |

| ● | risks related to our information technology systems and infrastructure; and |

| ● | our ability to remediate the material weaknesses in internal control over financial reporting identified in preparing our financial statements included in this prospectus and to subsequently maintain effective internal control over financial reporting. |

These factors are not necessarily all of the important factors that could cause actual results or events to differ materially from those expressed in forward-looking statements. Other unknown or unpredictable factors could also cause actual results or events to differ materially from those expressed in the forward-looking statements. Our future results will depend upon various other risks and uncertainties, including those described in Risk Factors. All forward-looking statements attributable to us are qualified in their entirety by this cautionary statement. Forward-looking statements speak only as of the date hereof. We undertake no obligation to update or revise any forward-looking statements after the date on which any such statement is made, whether as a result of new information, future events or otherwise.

iii

Table of Contents

This summary highlights basic information about us and this offering contained elsewhere in this prospectus. Because it is a summary, it does not contain all the information you should consider before investing in our Class A common stock. You should read and carefully consider this entire prospectus before making an investment decision, especially the information in Risk Factors, Cautionary Statement Regarding Forward-Looking Statements, Managements Discussion and Analysis of Financial Condition and Results of Operations and our consolidated financial statements and the accompanying notes. Except as otherwise indicated or required by the context, all references in this prospectus to the Company, we, us or our refer to Construction Partners, Inc. and its consolidated subsidiaries. All references in this prospectus to the selling stockholders refer to those entities identified as selling stockholders in Principal and Selling Stockholders.

Our Company

We are one of the fastest growing civil infrastructure companies in the United States specializing in the building and maintenance of transportation networks. Our operations leverage a highly skilled workforce, strategically located hot mix asphalt (HMA) plants, substantial construction assets and select material deposits. We provide construction products and services to both public and private infrastructure projects, with an emphasis on highways, roads, bridges, airports, and commercial and residential sites in the Southeastern United States. Led by industry veterans each with over 30 years of experience operating, acquiring and improving construction companies, we are well-positioned to continue to expand profitably in an industry with attractive growth prospects.

Since our inception in 2001, we have scaled into one of the largest operators in the Southeastern United States, growing from three to 26 HMA plants at September 30, 2017. We operate in a geographic area covering nearly 29,000 miles of highway infrastructure, and we produced 3.2 million tons of HMA in fiscal 2017 for use in more than 900 transportation or infrastructure projects. We maintain a high level of visibility on future infrastructure projects by analyzing the budgets and bidding patterns of state and local departments of transportation (DOTs) in the markets that we serve. We are therefore able to reliably forecast our bidding opportunities and properly plan for future projects. Our contract backlog at September 30, 2017 was at a record level of $549.9 million, as compared to $364.1 million at September 30, 2016.

The Southeastern United States is one of the fastest growing regions with respect to population and job growth, which drives additional federal funding to the area. The five states in which we operate (Alabama, Florida, Georgia, North Carolina and South Carolina) have experienced a combined annual population growth of 1.4% from 2000 to 2016, as compared to 0.8% for the rest of the United States, and combined annual economic growth of 2.6% from 2013 to 2016, as compared to 2.1% for the rest of the United States. Additionally, each of these states has recently passed legislation to increase transportation funding.

We have strategically entered each of the markets that we serve to capitalize on substantial public and private infrastructure opportunities in the Southeastern United States. Publicly funded projects accounted for approximately 70% of our fiscal 2017 construction contract revenues. Our public customers include federal agencies, state DOTs and local municipalities. Total public spending on transportation infrastructure in the United States was approximately $279.0 billion in 2014, of which highways and local roads accounted for approximately $165.0 billion, or 59%. We believe transportation infrastructure spending will increase as federal, state and local governments allocate funding to their aging transportation network infrastructures. At the federal level, the Fixing Americas Surface Transportation Act of 2015 (the FAST Act) earmarked $305.0 billion for transportation infrastructure spending through 2020. The FAST Act builds upon the Moving Ahead for Progress in the 21st

1

Table of Contents

Century Act (the MAP-21 Act), which was passed in 2012 and provided $105.0 billion of similar funding. Moreover, the current administration has proposed spending $1.0 trillion on infrastructure projects over the next ten years.

Privately funded projects accounted for approximately 30% of our fiscal 2017 construction contract revenues. We provide a wide range of large sitework construction and HMA paving services to private construction customers, including commercial and residential developers and local businesses. We compete for private construction projects primarily on the basis of the breadth of our service capabilities and our reputation for quality. Private projects also drive demand for external sales of our HMA and aggregates to smaller contractors that do not own HMA or aggregate facilities. We believe we are well-positioned to capitalize on the strong momentum in commercial and residential private construction sectors driven by population and economic expansion in the Southeastern United States.

Supported by our local market presence and knowledge, as well as scale advantages attributable to our vertical integration, geographic reach and strong financial profile, we believe we are a market leader in each of the markets that we serve. For all but the very largest projects, we compete primarily against local firms that have existing asphalt plants and paving operations relatively close to the project site. For most projects, HMA is a critical input that cannot be efficiently transported beyond a relatively short distance. By virtue of this locally driven competitive dynamic, competition in our industry is characterized by relative market share, which we define as the percentage of jobs we win in a local market compared to the jobs we bid in a local market.

Our Competitive Strengths

Leading Market Positions in Strategic Geographic Footprint. Our local market presence and knowledge contributes to our leading position in each of the markets we serve. Our 26 HMA plants are strategically located across Alabama, Florida, Georgia and North Carolina and are near interstate highways with dense road systems. In addition to the four states in which our HMA plants are located, we provide specialty paving services in South Carolina. We believe the Southeastern United States will continue to experience above-average population and economic growth and these factors will lead to additional demand for the transportation infrastructure services we provide. Moreover, this regions temperate climate allows us to work during the majority of the year, thereby enabling us to mitigate the fixed cost of weather-idled facilities and maintain a year-round workforce.

Scale Advantages. We believe our HMA plants, equipment fleet, experienced personnel and bonding capacity provide us with scale advantages over our competitors, which are primarily small- and medium-sized businesses and are often family owned and operated. In addition, our ability to internally source HMA provides project execution and bidding advantages over some of our competitors. Our flexible crews and diverse fleet of equipment are deployed across a wide geographic footprint to perform projects of varying size and scope, which helps us maintain high asset utilization and lower fixed unit costs. Our scale also allows us to fully utilize reclaimed asphalt pavement, which lowers our HMA production costs, and allows us to receive better terms in capital asset purchases with our equipment providers. Most of the projects for which we compete require surety performance bonds as a bidding condition. Many of our competitors are limited in the projects for which they can bid because of such bidding and bonding constraints. Our track record of successful project execution and profitability, coupled with a strong balance sheet, provide us with ample bidding and bonding capacity, allowing us to bid on a large number of projects simultaneously. As such, we have never been prevented from bidding a project due to bidding and bonding requirements. The scale advantages from our leading relative market position support our growth strategy.

Customer and Revenue Diversification. We perform both new construction and maintenance infrastructure services over a wide geographic footprint for both public and private clients. Our largest customers are state

2

Table of Contents

DOTs. Our largest customer accounted for 14.9%, and our 25 largest projects accounted for 22.4%, of our fiscal 2017 revenues. While we have the capabilities required to undertake large infrastructure projects, a core principle of our strategy is to perform many smaller projects with varied complexity and short durations. In fiscal 2017, our average project size was $1.7 million and our projects had an average duration of approximately eight months. We believe this strategy, coupled with our disciplined bidding process, yields revenue diversification and enables us to better manage our business through market cycles.

Consistent History of Managing Construction Projects and Contract Risk. Our long and successful track record in each of the markets that we serve demonstrates an understanding of the various risks associated with transportation infrastructure projects. We serve as prime contractor on approximately 70% of our projects and as a subcontractor on the remaining 30%. When serving as prime contractor, we utilize subcontractors to perform approximately 30% of the total project. The vast majority of our projects are fixed unit price contracts, pursuant to which a portion of our revenues is tied to the volume of various project components. We combine our experience, local market knowledge and fully integrated management information systems to effectively bid, execute and manage projects. We capture project costs such as labor and equipment expenses on a daily basis. Our managers review daily project reports to determine whether actual project costs are tracking to budget.

Successful Record of Executing and Integrating Acquisitions. Among our core competencies is successfully identifying, executing and integrating acquisitions. Since 2001, we have completed 15 acquisitions, which have enabled us to expand our end-markets, service offerings and geographic reach. We derive acquisition synergies by expanding the pool of project opportunities of our acquired companies by enhancing their service offerings and bidding capacities. Our acquisition philosophy involves retaining the local management team of the acquired business, maintaining operational decisions at the local level and providing strategic insights and leadership through our senior management team. Acquisition integration primarily involves the implementation of our standardized bidding and management information systems across the functional areas of accounting and operations. These information systems provide acquired companies with the necessary tools to capture and analyze cost and to improve operating results.

Common Processes and Technology Systems. We employ a common set of operational processes and utilize sophisticated technology systems to track all of our operations. These practices and systems are important competitive advantages in several areas of our business. Our uniform estimating and job cost systems, developed for our business and improved internally, offer a critical advantage not only in the procurement of work, but also the procurement of profitable work, by providing an accurate measure of our cost for individual items in a bid. In contrast, we believe many of our competitors have not invested equivalent resources to develop systems with the same level of detail, which can make them less competitive in the bidding process and/or less profitable. We also track and analyze our competitors historical bids and bidding tendencies, which provides us with a critical bidding advantage. Since all of our project teams utilize the same processes and are trained to the same standards, our management tools allow us to optimize personnel and equipment usage across our project portfolio during project execution, improving asset utilization and providing significant cost savings.

Experienced Management Team and Supportive Sponsor. Our executive officers are seasoned leaders with complementary skill sets and a track record of financial success spanning over 30 years and multiple business cycles. As former executives of the North American arm of an international construction company, our Chief Executive Officer and our Chief Financial Officer built a civil infrastructure company which operated over 50 HMA plants in five states before its sale in 1999. Collectively, they have successfully completed approximately 50 acquisitions in the civil infrastructure sector over the course of their careers. Our five Senior Vice Presidents

3

Table of Contents

possess over 150 years of combined management experience with both publicly and privately held civil infrastructure companies operating in the Southeastern United States. In addition, following this offering, funds managed by SunTx Capital Management Corp. and its affiliates (SunTx) will continue to own a significant economic interest in our Company. After giving effect to this offering and the Reclassification (as defined herein), SunTx will own shares of our Class B common stock and % of the voting power of our outstanding common stock. The Executive Chairman of our board of directors Ned N. Fleming, III, played a key role in our founding, and we believe that we will continue to benefit from his ongoing involvement following the completion of this offering. Furthermore, we believe that our dual-class capital structure will contribute to the stability and continuity of our board of directors and senior management, allowing them to focus on creating long-term stockholder value.

Our Growth Strategy

Capitalize on Increased State and Federal Spending on U.S. Transportation Infrastructure. There is currently an $836.0 billion backlog of projects to repair deteriorating bridges and highways in the United States. According to the American Society of Civil Engineers, the roads in each of the states in which we operate received infrastructure report cards with a grade of B- or C. We expect the poor condition of the roads in the markets that we serve to provide consistent opportunities for growth. Funding for projects in these markets will come from a variety of sources. In addition to the FAST Act and other legislative proposals, each state in which we operate maintains a transportation infrastructure fund supported primarily by fuel taxes. Whether by state constitution or statute, these funds are generally protected and required to be used for transportation infrastructure purposes. We are well-positioned to take advantage of increased infrastructure spending due to our broad footprint of existing HMA production facilities designed with significant excess capacity across the Southeastern United States.

Organically Expand Our Geographic Footprint. We believe the economic climate of the Southeastern United States is more favorable than other parts of the country with commensurate population growth trends, which will lead to significant future federal, state and local infrastructure spending. We have the financial and organizational resources to add additional workforce and equipment, and we are highly experienced in developing new plant sites to expand into adjacent markets. In addition, we maintain strategic partnerships with subcontractors affording additional scalability in labor and equipment. Our financial profile and track record also facilitate significant growth in bonding capacitya challenge that may prove difficult for smaller, privately held competitors. We continually evaluate opportunities to expand organically in the Southeastern United States.

Consistent Pursuit of Acquisitions. Over the last 16 years, our consistent organic growth has been augmented by the successful acquisition and integration of 15 complementary businesses, establishing us as a leading industry consolidator. Our management team has acquired businesses in a variety of economic cycles, with the number of opportunities generally increasing in cyclical downturns. Our senior management team has successfully completed approximately 50 acquisitions over the course of their careers. Our management teams experience, industry expertise, integrity and strong relationships with industry players allow us to be considered a buyer-of-choice with targeted, high-quality prospective targets, most of which are family owned and operated. These advantages, together with the proceeds of this offering and the opportunity to use our equity as a component of acquisition consideration, should further enhance our acquisition prospects. We maintain an acquisition pipeline with a growing number of opportunities to expand our geographic footprint. While most opportunities in our pipeline consist of add-on acquisitions in the Southeastern United States, we also continuously evaluate platform investments that would allow expansion into neighboring states.

Consistent with this strategy, on September 22, 2017, we completed an approximately $10.8 million asset acquisition of certain sand and gravel mining operations located in Etowah, Elmore and Autauga counties in

4

Table of Contents

Alabama. This acquisition increases our aggregate reserves and allows us to further capitalize on vertical integration opportunities.

Continue to Capitalize on Vertical Integration Opportunities. We consume approximately 80% of the HMA we produce. In certain markets, we also mine aggregates, such as sand and gravel, used as raw materials in the production of HMA, which lowers our input costs. We believe there are additional vertical integration opportunities to enhance operational efficiency and allow us to capture additional margin throughout the value chain, including the acquisition or development of additional aggregate sites and liquid asphalt terminals.

Enhance Profitability Through Operational Improvements. We complement sophisticated business practices across our platform with fully integrated management information systems to drive operational efficiencies. With strategic oversight by our management team, operating income margins increased 310 basis points from fiscal 2015 to fiscal 2017. These margin improvements have been accomplished through profit optimization plans and leveraging information technology and financial systems to improve project execution and control costs. Moreover, we improve margins on acquired businesses as we standardize business practices across functional areas, including, but not limited to, estimation, project management, finance, information technology, risk management, purchasing and fleet management.

Strengthen and Support Human Capital. We have an experienced and skilled workforce of over 1,800 employees, which we believe is our most valuable asset. Attracting, training and retaining key personnel have been and will remain critical to our success. We will continue to focus on providing our personnel with training, personal and professional growth opportunities, performance-based incentives, stock ownership opportunities and other competitive benefits in order to strengthen and support our human capital base.

Our Industry

We operate in the large and growing highway and road construction industry, which generated approximately $165.0 billion of revenues in 2014. Federal, state and local DOT budgets drive industry performance, with the public sector generating 95% of total industry revenues in 2016. In 2015, the FAST Act was passed, providing visibility and certainty of funding and planning for state DOTs. The FAST Act earmarked $305.0 billion for transportation infrastructure spending through 2020, with highway and transit projects accounting for $205.0 billion and $48.0 billion, respectively. The current administration recently proposed spending $1.0 trillion over the next ten years on infrastructure projects, which could also drive an increase in spending on the significant backlog of national and local transportation infrastructure needs. The non-discretionary nature of highway and road construction services and materials supports highly stable and consistent industry growth.

Additionally, there are strong industry tailwinds in each of the five states in which we operate. The Alabama Transportation Rehabilitation and Improvement Program and Rural Assistance Match Program, created in 2012 and 2013, respectively, are initiatives aimed at investing $1.2 billion and $25.0 million, respectively, on the states transportation infrastructure. The Florida Department of Transportation received $10.8 billion of funding for the 2017 fiscal year, with $4.1 billion specifically allocated for highway construction projects. In 2015, Georgia passed House Bill 170, replacing 34 short-term funding programs and providing $1.0 billion per year for transportation needs with a focus on the states backlog of maintenance projects. In 2017, the North Carolina State Transportation Improvement Program increased the states plan from a $320.0 million two-year program to a ten-year program estimated at $1.6 billion in additional transportation revenue. Finally, in 2016, South Carolina passed Act 275, which provides $4.2 billion in transportation infrastructure funding over the next ten years, an

5

Table of Contents

increase of $150.0 million per year over prior funding levels, with $2.0 billion directed toward widening and improving existing interstates and $1.4 billion directed toward pavement resurfacing.

Within the highway and road construction industry, we operate in the asphalt paving materials and services segment. Asphalt paving mix is the most common roadway material used today, covering 94% of the more than 2.7 million miles of paved U.S. roadways. We believe asphalt will continue to be the pavement of choice for roads due to its cost effectiveness, durability and reusability, as well as minimized traffic disruption during paving, as compared to concrete.

Competition is constrained in our industry because participants are limited by the distance that materials can be efficiently transported, resulting in a fragmented market of over 13,300 businesses, many of which are local or regional operators. Participants in these markets range from small, privately-held companies focused on a single material, product or market to multinational corporations that offer a wide array of construction materials, products and paving and related services. In each market, our primary competitors are primarily local businesses, with an occasional large, national corporation providing competition.

Risk Factors

An investment in our Class A common stock involves a number of risks. You should carefully read and consider all of the information contained in this prospectus (including in Risk Factors, Managements Discussion and Analysis of Financial Condition and Results of Operations and our consolidated financial statements and the notes thereto) before making an investment decision. These risks could adversely affect our business, financial condition and results of operations, and cause the trading price of our Class A common stock to decline. You could lose part or all of your investment. In reviewing this prospectus, you should bear in mind that past results are no guarantee of future performance. See Cautionary Statement Regarding Forward-Looking Statements for a discussion of forward-looking statements, and the significance of forward-looking statements in the context of this prospectus.

These risks include, but are not limited to:

| ● | declines in public infrastructure construction and reductions in government funding, including the funding by transportation authorities and other state and local agencies; |

| ● | risks related to our operating strategy; |

| ● | competition for projects in our local markets; |

| ● | risks associated with our capital-intensive business; |

| ● | government requirements and initiatives, including those related to funding for public or infrastructure construction, land usage and environmental, health and safety matters; |

| ● | unfavorable economic conditions and restrictive financing markets; |

| ● | our ability to successfully identify, manage and integrate acquisitions; |

| ● | our ability to obtain sufficient bonding capacity to undertake certain projects; |

| ● | our ability to accurately estimate the overall risks, requirements or costs when we bid on or negotiate contracts that are ultimately awarded to us; |

| ● | the cancellation of a significant number of contracts or our disqualification from bidding for new contracts; |

| ● | risks related to adverse weather conditions; |

| ● | our substantial indebtedness and the restrictions imposed on us by the terms thereof; |

| ● | our ability to maintain favorable relationships with third parties that supply us with equipment and essential supplies; |

| ● | our ability to retain key personnel and maintain satisfactory labor relations; |

| ● | property damage, results of litigation and other claims and insurance coverage issues; |

6

Table of Contents

| ● | risks related to our information technology systems and infrastructure; and |

| ● | our ability to remediate the material weaknesses in internal control over financial reporting identified in preparing our financial statements included in this prospectus and to subsequently maintain effective internal control over financial reporting. |

Our Sponsor

SunTx, founded in 2001, is a Dallas-based private equity firm that invests in growth-oriented middle-market manufacturing, distribution and service companies. At March 31, 2017, SunTx had approximately $1.2 billion assets under management.

Corporate History

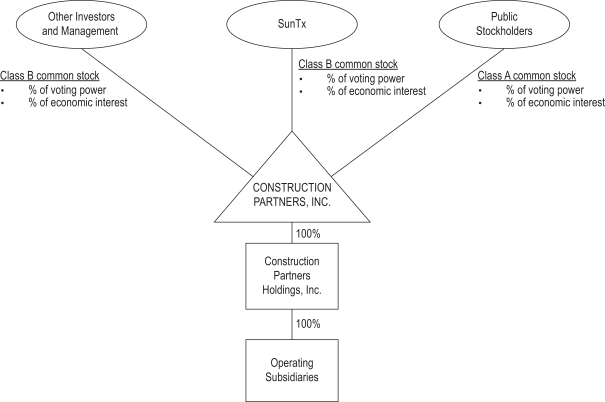

Construction Partners, Inc. is a holding company that was incorporated as a Delaware corporation in 2007. We operate and control our business and affairs through our wholly owned subsidiaries: Wiregrass Construction Company, Inc., Fred Smith Construction, Inc., Everett Dykes Grassing Co., Inc. and C.W. Roberts Contracting, Inc. Immediately prior to the completion of this offering, we will amend and restate our certificate of incorporation to effectuate a dual class common stock structure consisting of our Class A common stock and our Class B common stock, as a result of which each share of our common stock, par value $0.001 per share, immediately prior to the completion of this offering will, automatically and without any action on the part of the holders thereof, be reclassified and changed into shares of our Class B Common Stock so that all of our equity holders prior to the completion of this offering will become the holders of our Class B common stock. We refer to this as the Reclassification. See Description of Our Capital Stock. The diagram below depicts our organizational structure and ownership immediately following the completion of this offering.

7

Table of Contents

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in annual gross revenue during our last fiscal year, we qualify as an emerging growth company as defined in Section 2(a) of the Securities Act of 1933, as amended (the Securities Act), as modified by the Jumpstart Our Business Startups Act of 2012 (the JOBS Act). An emerging growth company may take advantage of specified reduced reporting requirements that are otherwise applicable generally to public companies. These provisions include:

| ● | an option to present only two years of audited financial statements and related managements discussion and analysis in the registration statement of which this prospectus is a part; |

| ● | an exemption from compliance with the requirement for auditor attestation of the effectiveness of our internal control over financial reporting for so long as we qualify as an emerging growth company; |

| ● | an exemption from compliance with any requirement that the Public Company Accounting Oversight Board may adopt regarding mandatory audit firm rotation or a supplement to the auditors report providing additional information about the audit and the financial statements; |

| ● | an exemption from the adoption of new or revised financial accounting standards until they would apply to private companies; |

| ● | reduced disclosure about our executive compensation arrangements; and |

| ● | an exemption from the requirements to obtain a non-binding advisory vote on executive compensation or a stockholder approval of any golden parachute arrangements. |

We will remain an emerging growth company until the earliest to occur of: the last day of the year in which we have $1.07 billion or more in annual gross revenue; the date we qualify as a large accelerated filer with at least $700.0 million of equity securities held by non-affiliates as of the last day of our most recently completed second quarter; the issuance, in any three-year period, by us of more than $1.0 billion in non-convertible debt securities; and the last day of the year ending after the fifth anniversary of this offering. We may choose to take advantage of some, but not all, of the available benefits under the JOBS Act. We are choosing to irrevocably opt out of the extended transition periods available under the JOBS Act for complying with new or revised accounting standards, but we intend to take advantage of certain of the other exemptions discussed above. Accordingly, the information contained herein may be different from the information you receive from other public companies. See Risk FactorsRisks Related to this Offering and Ownership of Our Class A Common Stock. We cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our Class A common stock less attractive to investors.

Corporate Offices and Internet Address

Our principal operating offices are located at 290 Healthwest Drive, Suite 2, Dothan, Alabama 36303, and our phone number is (334) 673-9763. Our website address is www.constructionpartners.net. Information contained on our website is not incorporated by reference in, and does not constitute a part of, this prospectus.

8

Table of Contents

The Offering

| Class A common stock offered by us |

shares |

| Class A common stock offered by the selling stockholders |

shares (or shares if the underwriters option to purchase additional shares is exercised in full) |

| Class A common stock to be outstanding upon the completion of this offering |

shares (or shares if the underwriters option to purchase additional shares is exercised in full) |

| Class B common stock to be outstanding upon the completion of this offering |

shares (or shares if the underwriters option to purchase additional shares is exercised in full) |

| Class A and Class B common stock to be outstanding upon the completion of this offering |

shares (or shares if the underwriters option to purchase additional shares is exercised in full) |

| Option to purchase additional shares |

The selling stockholders have granted to the underwriters a 30-day option to purchase up to additional shares of our Class A common stock at the initial public offering price less the underwriting discount and commissions. |

| Use of proceeds |

We estimate that our net proceeds from this offering, after deducting estimated underwriting discounts and approximately $ million of estimated offering expenses payable by us, will be approximately $ million, assuming an initial public offering price of $ per share (the midpoint of the range set forth on the cover of this prospectus). We will not receive any proceeds from the sale of shares by the selling stockholders. We intend to use these net proceeds to provide growth capital, to fund acquisitions and for general corporate purposes, which may include the repayment of debt from time to time. See Use of Proceeds. |

| Dual class common stock |

Upon the completion of this offering, the rights of the holders of our Class A common stock and our Class B common stock will be identical, except with respect to voting rights, conversion rights and certain transfer restrictions applicable to our Class B common stock. See Description of Our Capital StockCommon Stock. |

| Upon the completion of this offering, the holders of our Class A common stock will be entitled to one vote per share and the holders of our Class B common stock will be entitled to votes per share. The holders of our Class A common stock and our Class B common |

9

Table of Contents

| stock will vote together as a single class on all matters unless otherwise required by law. See Description of Our Capital StockCommon StockVoting Rights. |

| Each share of our Class B common stock may be converted into one share of our Class A common stock at the option of the holder. In addition, each share of our Class B common stock will automatically convert into one share of our Class A common stock upon any transfer, with certain exceptions. See Description of Our Capital StockCommon StockConversion and Restrictions on Transfer. |

| Upon the completion of this offering, the holders of our Class A common stock will hold approximately % of the total voting power of our outstanding common stock and approximately % of our total equity ownership (or % and %, respectively, if the underwriters option to purchase additional shares is exercised in full), and the holders of our Class B common stock will hold approximately % of the total voting power of our outstanding common stock and approximately % of our total equity ownership (or % and %, respectively, if the underwriters option to purchase additional shares is exercised in full). |

| Dividend policy |

We anticipate that we will retain all future earnings, if any, to finance the growth and development of our business. We do not intend to pay cash dividends in the foreseeable future. See Dividend Policy. |

| Listing symbol |

We intend to apply to list our Class A common stock on under the symbol . |

| Risk factors |

You should carefully read and consider the information in Risk Factors on page 13 of this prospectus for a discussion of factors to carefully consider before investing in our Class A common stock. |

Unless the context otherwise requires, the information in this prospectus:

| ● | assumes that the shares of our Class A common stock to be sold in this offering are sold at $ per share (the midpoint of the range set forth on the cover of this prospectus); |

| ● | assumes that all shares of our Class A common stock offered hereby are sold; |

| ● | assumes no exercise by the underwriters of their option to purchase additional shares; |

| ● | assumes the filing and effectiveness of our amended and restated certificate of incorporation to effect the Reclassification and the adoption of our amended and restated bylaws, each of which will occur immediately prior to the completion of this offering; |

| ● | assumes no exercise of outstanding options; and |

| ● | excludes shares of our Class A common stock reserved for issuance under the 2018 Equity Incentive Plan. |

10

Table of Contents

Summary Historical Consolidated Financial Data

The following tables present our summary historical consolidated financial data for the periods and at the dates indicated. The statement of operations data for the years ended September 30, 2016 and 2017 and the balance sheet data at September 30, 2016 and 2017 are derived from our audited consolidated financial statements and the notes thereto included elsewhere in this prospectus.

Historical results are not necessarily indicative of the results we expect in future periods. The data presented below should be read in conjunction with, and are qualified in their entirety by reference to, Capitalization, Managements Discussion and Analysis of Financial Condition and Results of Operations and our consolidated financial statements and the notes thereto included elsewhere in this prospectus.

| For the Years Ended September 30, | ||||||||||

| 2016 | 2017 | |||||||||

| (in thousands except share and per share data) | ||||||||||

| Statement of Income Data: |

||||||||||

| Revenues |

$ | 542,347 | $ | 568,212 | ||||||

| Cost of revenues |

467,464 | 477,241 | ||||||||

|

|

|

|

|

|||||||

| Gross profit |

74,883 | 90,971 | ||||||||

| General and administrative expenses |

(40,428 | ) | (47,867 | ) | ||||||

| Gain on sale of equipment, net |

2,997 | 3,481 | ||||||||

|

|

|

|

|

|||||||

| Operating income |

37,452 | 46,585 | ||||||||

| Interest expense, net |

(4,662 | ) | (3,960 | ) | ||||||

| Loss on extinguishment of debt |

| (1,638 | ) | |||||||

| Other expense |

(227 | ) | (205 | ) | ||||||

|

|

|

|

|

|||||||

| Income before provision for income taxes |

32,563 | 40,782 | ||||||||

| Provision for income taxes |

10,541 | 14,742 | ||||||||

|

|

|

|

|

|||||||

| Net income |

$ | 22,022 | $ | 26,040 | ||||||

|

|

|

|

|

|||||||

| Net income per share attributable to common stockholders: |

||||||||||

| Basic and diluted |

$ | 12.90 | $ | 15.79 | ||||||

| Weighted average number of common shares outstanding: |

||||||||||

| Basic and diluted |

1,706,711 | 1,648,821 | ||||||||

| Other Financial Data: |

||||||||||

| Adjusted EBITDA(1) |

$ | 58,972 | $ | 67,965 | ||||||

| Revenues |

$ | 542,347 | $ | 568,212 | ||||||

| Adjusted EBITDA Margin(1) |

10.9 | % | 12.0 | % | ||||||

| Statement of Cash Flows Data: |

||||||||||

| Net cash provided by operating activities |

$ | 51,694 | $ | 46,927 | ||||||

| Net cash used in investing activities |

(19,005 | ) | (30,686 | ) | ||||||

| Net cash used in financing activities |

(20,881 | ) | (39,779 | ) | ||||||

11

Table of Contents

| At September 30, | ||||||||||

| 2016 | 2017 | |||||||||

| (in thousands) | ||||||||||

| Balance Sheet Data: |

||||||||||

| Cash |

$ | 51,085 | $ | 27,547 | ||||||

| Total assets |

318,282 | 328,550 | ||||||||

| Current and non-current portions of debt, net of deferred debt issuance cost |

60,962 | 57,136 | ||||||||

| Total equity |

156,283 | 152,181 | ||||||||

| (1) | Adjusted EBITDA represents net income before interest expense, net, provision for income taxes, depreciation, depletion and amortization, equity-based compensation expense and loss on extinguishment of debt. Adjusted EBITDA Margin represents Adjusted EBITDA as a percentage of revenues for each period. These metrics are supplemental measures of our operating performance that are neither required by, nor presented in accordance with, generally accepted accounting principles in the United States (GAAP). These measures should not be considered as an alternative to net income or any other performance measure derived in accordance with GAAP as an indicator of our operating performance. We present Adjusted EBITDA and Adjusted EBITDA Margin because management uses these measures as key performance indicators, and we believe they are measures frequently used by securities analysts, investors and other parties to evaluate companies in our industry. These measures have limitations as analytical tools and should not be considered in isolation or as substitutes for analysis of our results as reported under GAAP. |

Our calculation of Adjusted EBITDA and Adjusted EBITDA Margin may not be comparable to similarly named measures reported by other companies. Potential differences between our measure of Adjusted EBITDA compared to other similar companies measures of Adjusted EBITDA may include differences in capital structures, tax positions and the age and book depreciation of intangible and tangible assets.

The following table presents a reconciliation of net income, the most directly comparable measure calculated in accordance with GAAP, to Adjusted EBITDA, and the calculation of Adjusted EBITDA Margin for each of the periods presented.

| For the Years Ended September 30, | ||||||||

| 2016 | 2017 | |||||||

| (in thousands) | ||||||||

| Net income |

$ | 22,022 | $ | 26,040 | ||||

| Interest expense, net |

4,662 | 3,960 | ||||||

| Provision for income taxes |

10,541 | 14,742 | ||||||

| Depreciation, depletion and amortization |

21,530 | 21,072 | ||||||

| Equity-based compensation expense |

217 | 513 | ||||||

| Loss on extinguishment of debt |

| 1,638 | ||||||

|

|

|

|

|

|||||

| Adjusted EBITDA |

$ | 58,972 | $ | 67,965 | ||||

|

|

|

|

|

|||||

| Revenues |

$ | 542,347 | $ | 568,212 | ||||

| Adjusted EBITDA Margin |

10.9 | % | 12.0 | % | ||||

12

Table of Contents

An investment in our Class A common stock involves a high degree of risk. You should carefully read and consider the following risks, as well as all of the other information contained in this prospectus, before making an investment decision. Our business, financial condition and results of operations could be materially and adversely affected by any of these risks. As a result, the trading price of our Class A common stock could decline, and you could lose all or part of your investment. The risks described below are not the only ones facing us. Additional risks not presently known to us or that we currently consider immaterial also may adversely affect us.

Risks Related to our Business

A significant slowdown or decline in economic conditions, particularly in the Southeastern United States, could adversely impact our results of operations.

We currently operate in Alabama, Florida, Georgia, North Carolina and South Carolina. A significant slowdown or decline in economic conditions or uncertainty regarding the economic outlook in the United States generally, or in any of these states particularly, could result in reduced demand for infrastructure projects, which could materially adversely affect our financial condition, results of operations and liquidity. Demand for infrastructure projects depends on the overall condition of the U.S. and local economies, the need for new or replacement infrastructure, the priorities placed on various projects funded by governmental entities and federal, state and local government spending levels. In particular, low tax revenues, credit rating downgrades, budget deficits and financing constraints, including timing and amount of federal funding and competing governmental priorities, could negatively impact the ability of government agencies to fund existing or new public infrastructure projects. For example, during the most recent recession, decreases in tax revenues reduced funding for infrastructure projects. In addition, any instability in the financial and credit markets could negatively impact our customers ability to pay us on a timely basis, or at all, for work on projects already in progress, could cause our customers to delay or cancel construction projects in our contract backlog and/or could create difficulties for customers to obtain adequate financing to fund new construction projects, including through the issuance of municipal bonds.

Our business is dependent on federal, state and local government spending for public infrastructure construction, and reductions in government funding could adversely affect our results of operations.

During fiscal 2017, we generated approximately 70% of our construction contract revenues from publicly funded construction projects at the federal, state and local levels. As a result, if publicly funded construction decreases due to reduced federal, state or local funding or otherwise, our financial condition, results of operations and liquidity could be materially adversely affected.

In January 2011, Congress repealed a 1998 transportation law that protected annual highway funding levels from amendments that could reduce such funding. This change subjected federal highway funding to annual appropriation reviews, which has increased the uncertainty of many state DOTs regarding the availability of highway project funds. This uncertainty could cause state DOTs to be reluctant to undertake large multiyear highway projects, which could, in turn, negatively affect our results of operations.

Federal highway bills provide spending authorizations that represent maximum amounts. Each year, Congress passes an appropriation act establishing the amount that can be used for particular programs. The annual funding level is generally tied to receipts of highway user taxes placed in the Highway Trust Fund (as defined in the FAST Act). Once Congress passes the annual appropriation, the federal government distributes funds to each state based on formulas or other procedures. States generally must spend these funds on the specific programs

13

Table of Contents

outlined in the federal legislation. In recent years, The Highway Trust Fund has faced insolvency as outlays have outpaced revenues. Annual shortfalls have been addressed primarily by short-term measures, including the transfer of funds from the General Fund (as defined in the FAST Act) into the Highway Trust Fund. As a result, we cannot be assured of the existence, timing or amount of future federal highway funding. Any reduction in federal highway funding, particularly in the amounts allocated to Alabama, Florida, Georgia, North Carolina and South Carolina, could have a material adverse effect on our results of operations.

Each state funds its infrastructure spending from specially allocated amounts collected from various taxes, typically fuel taxes and vehicle fees, as well as from voter-approved bond programs. Shortages in state tax revenues can reduce the amount spent on state infrastructure projects. Delays in state infrastructure spending can adversely affect our business. Many states have experienced state-level funding pressures caused by lower tax revenues and an inability to finance approved projects. Prior to the FAST Act, states took on a larger role in funding sustained infrastructure investment. During the past two years, many states have again taken on a significantly larger role in funding infrastructure investment, including initiating special-purpose taxes and increased fuel taxes.

While the current administration has called for an infrastructure stimulus plan, there is a lack of clarity around both the timing and the details of any such plan and the impact, if any, that it or other proposed changes in law and regulations may have on our business.

Government contracts generally are subject to a variety of governmental regulations, requirements and statutes, the violation or alleged violation of which could have a material adverse effect on our business.

Our business is substantially dependent upon infrastructure projects funded by federal, state and local governmental agencies. Our contracts with these governmental agencies are generally subject to specific procurement regulations, contract provisions and a variety of socioeconomic requirements relating to their formation, administration, performance and accounting. Further, government contracts typically provide for termination at the convenience of the customer with requirements to pay us for work performed through the date of termination. We may be subject to claims for civil or criminal fraud for actual or alleged violations of these various governmental regulations, requirements or statutes. In addition, we may also be subject to qui tam litigation brought by private individuals on behalf of the government under the Federal Civil False Claims Act, which could include claims for up to treble damages. Further, if we fail to comply with any of these various governmental regulations, requirements or statutes or if we have a substantial number of accumulated Occupational Safety and Health Administration (OSHA), Mine Safety and Health Administration (MSHA) or other workplace safety violations, our existing government contracts could be terminated. Even if we have not violated these various governmental regulations, requirements or statutes, allegations of violations or defending qui tam litigation could harm our reputation and require us to incur material costs to defend any such allegations or lawsuits, which could have a material adverse effect on our financial condition, results of operations or liquidity.

If we do not comply with certain federal or state laws, we could be suspended or debarred from government contracting, which could have a material adverse effect on our business.

Various statutes to which our operations are subject, including the Davis-Bacon Act (regulating wages and benefits), the Walsh-Healy Act (prescribing a minimum wage and regulating overtime and working conditions), Executive Order 11246 (establishing equal employment opportunity and affirmative action requirements) and the Drug-Free Workplace Act, provide for mandatory suspension and/or debarment of contractors in certain circumstances involving statutory violations. In addition, the Federal Acquisition Regulation and various state statutes provide for discretionary suspension and/or debarment in certain circumstances, including as a result of

14

Table of Contents

being convicted of, or being found civilly liable for, fraud or a criminal offense in connection with obtaining, attempting to obtain or performing a public contract or subcontract. The scope and duration of any suspension or debarment may vary depending upon the facts of a particular case and the statutory or regulatory grounds for debarment. Any suspension or debarment from government contracting could have a material adverse effect on our financial condition, results of operations or liquidity.

If we are unable to accurately estimate the overall risks, revenues or costs on our projects, we may incur contract losses or achieve lower than anticipated profits.

Pricing on a fixed unit price contract is based on approved quantities irrespective of our actual costs, and contracts with a fixed total price require that the work be performed for a single price irrespective of our actual costs. We only generate profits on fixed unit price and fixed total price contracts when our revenues exceed our actual costs, which requires us to accurately estimate our costs, to control actual costs and to avoid cost overruns. If our cost estimates are too low or if we do not perform the contract within our cost estimates, then cost overruns may cause us to incur a loss or cause the contract not to be as profitable as we expected. The costs incurred and profit realized, if any, on our contracts can vary, sometimes substantially, from our original projections due to a variety of factors, including, but not limited to:

| ● | the failure to include materials or work in a bid, or the failure to estimate properly the quantities or costs needed to complete a fixed total price contract; |

| ● | delays caused by weather conditions or otherwise failing to meet scheduled acceptance dates; |

| ● | contract or project modifications or conditions creating unanticipated costs that are not covered by change orders; |

| ● | changes in the availability, proximity and costs of materials, including liquid asphalt, cement, aggregates and other construction materials, as well as fuel and lubricants for our equipment; |

| ● | to the extent not covered by contractual cost escalators, variability and inability to predict the costs of purchasing diesel, liquid asphalt and cement; |

| ● | the availability and skill level of workers; |

| ● | the failure by our suppliers, subcontractors, designers, engineers or customers to perform their obligations; |

| ● | fraud, theft or other improper activities by our suppliers, subcontractors, designers, engineers, customers or our own personnel; |

| ● | mechanical problems with our machinery or equipment; |

| ● | citations issued by a government authority, including under OSHA or MSHA; |

| ● | difficulties in obtaining required government permits or approvals; |

| ● | changes in applicable laws and regulations; |

| ● | uninsured claims or demands from third parties for alleged damages arising from the design, construction or use and operation of a project of which our work is part; and |

| ● | public infrastructure customers seeking to impose contractual risk-shifting provisions that result in our facing increased risks. |

These factors, as well as others, may cause us to incur losses, which could have a material adverse effect on our financial condition, results of operations or liquidity.

Because our industry is capital intensive and we have significant fixed and semi-fixed costs, our profitability is sensitive to changes in volume.

The property, plants and equipment needed to produce our products and provide our services can be very expensive. We must spend a substantial amount of capital to purchase and maintain such property, plants and equipment. Although we believe our current cash balance, along with our projected internal cash flows and available financing sources, will provide sufficient cash to support our currently anticipated operating and capital

15

Table of Contents

needs, if we are unable to generate sufficient cash to purchase and maintain the property, plants and equipment necessary to operate our business, we may be required to reduce or delay planned capital expenditures or to incur additional indebtedness. In addition, due to the level of fixed and semi-fixed costs associated with our business, particularly at our HMA production facilities, volume decreases could have a material adverse effect on our financial condition, results of operations or liquidity.

The cancellation of a significant number of contracts, our disqualification from bidding for new contracts and the unpredictable timing of new contracts could have a material adverse effect on our business.

We could be prohibited from bidding on certain government contracts if we fail to maintain qualifications required by those entities. In addition, government contracts can typically be canceled at any time with our receiving payment only for the work completed. The cancellation of an unfinished contract or our disqualification from the bidding process could result in lost revenues and cause our equipment to be idled for a significant period of time until other comparable work becomes available. Additionally, the timing of project awards is unpredictable and outside of our control. Project awards, including expansions of existing projects, often involve complex and lengthy negotiations and competitive bidding processes.

The success of our business depends, in part, on our ability to execute on our acquisition strategy, to successfully integrate acquired businesses and to retain key employees of acquired businesses.

Over the last 16 years, we have acquired and integrated 15 complementary businesses, which have contributed to a significant portion of our growth. We continue to evaluate strategic acquisition opportunities that have the potential to support and strengthen our business, including acquisitions in neighboring states, as part of our ongoing growth strategy. We expect to evaluate, negotiate and enter into possible acquisition transactions on an ongoing basis in the future. We expect to regularly make non-binding acquisition proposals, and we may enter into non-binding, confidential letters of intent from time to time in the future. We cannot predict the timing or size of any future acquisitions. To successfully acquire a significant target, we may need to raise additional equity and/or indebtedness, which could increase our leverage level. There can be no assurance that we will enter into definitive agreements with respect to any contemplated transaction or that any contemplated transaction will be completed. The investigation of acquisition candidates and the negotiation, drafting and execution of relevant agreements, disclosure documents and other instruments will require substantial management time and attention and substantial costs for accountants, attorneys and others. If we fail to complete any acquisition for any reason, including events beyond our control, the costs incurred up to that point for the proposed acquisition likely would not be recoverable.

Acquisitions typically require integration of the acquired companys estimation, project management, finance, information technology, risk management, purchasing and fleet management functions. We may be unable to successfully integrate an acquired business into our existing business, and an acquired business may not be as profitable as we had expected or at all. Our inability to successfully integrate new businesses in a timely and orderly manner could increase costs, reduce profits or generate losses. Factors affecting the successful integration of an acquired business include, but are not limited to, the following:

| ● | we may become liable for certain liabilities of an acquired business, whether or not known to us, which could include, among others, tax liabilities, product liabilities, environmental liabilities and liabilities for employment practices, and these liabilities could be significant; |

| ● | we may not be able to retain local managers and key employees who are important to the operations of an acquired business; |

| ● | substantial attention from our senior management and the management of an acquired business may be required, which could decrease the time that they have to service and attract customers; |

16

Table of Contents

| ● | we may not effectively utilize new equipment that we acquire through acquisitions; |

| ● | the complete integration of an acquired company depends, to a certain extent, on the full implementation of our financial and management information systems, business practices and policies; and |

| ● | we may actively pursue a number of opportunities simultaneously and we may encounter unforeseen expenses, complications and delays, including difficulties in employing sufficient staff and maintaining operational and management oversight. |

Acquisitions involve risks that the acquired business will not perform as expected and that business judgments concerning the value, strengths and weaknesses of the acquired business will prove incorrect. In addition, potential acquisition targets may be in states in which we do not currently operate, which could result in unforeseen operating difficulties and difficulties in coordinating geographically dispersed operations, personnel and facilities. In addition, if we enter into new geographic markets, we may be subject to additional and unfamiliar legal and regulatory requirements.

We cannot guarantee that we will achieve synergies and cost savings in connection with future acquisitions. Many of the businesses that we have acquired and may acquire in the future have unaudited financial statements that have been prepared by management and have not been independently reviewed or audited. We cannot guarantee that such financial statements would not be materially different if such statements were independently reviewed or audited. We cannot guarantee that we will continue to acquire businesses at valuations consistent with our prior acquisitions or that we will complete future acquisitions at all. We cannot guarantee that there will be attractive acquisition opportunities at reasonable prices, that financing will be available or that we can successfully integrate acquired businesses into our existing operations. In addition, our results of operations from these acquisitions could, in the future, result in impairment charges for any of our intangible assets, including goodwill or other long-lived assets, particularly if economic conditions worsen unexpectedly. Our inability to effectively manage the integration of our completed and future acquisitions could prevent us from realizing expected rates of return on an acquired business and could have a material and adverse effect on our financial condition, results of operations or liquidity.

We may lose business to competitors that underbid us, and we may be unable to compete favorably in our highly competitive industry.